capital gains tax increase effective date

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. This resulted in a 60 increase in the capital gains tax collected in 1986.

The Capital Gains Dilemma Northern Trust

President Biden has proposed a substan tial increase in the capital gains rate.

. Income Tax Return for Seniors. The 486 rate includes a 38 net. If the capital gains tax rate were to increase to 396 prior to the date of sale the sale price would have to increase by 32to 132 millionto net the same 8 million.

The maximum rate on long-term. This resulted in a 60 increase in the capital gains tax collected in 1986. The proposal would increase the maximum stated capital gain rate from 20 to 25.

It avoids uncertainty for taxpayers and raises more tax dollars at least in the short run. Dems eye pre-emptive capital gains effective date April 27 2021 Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the. A prospective effective date does two things.

The 1987 capital gains tax collections were slightly below 1985. Would have the highest top capital-gains tax rates among OECD countries if President Bidens proposal were enacted. Increase the top ordinary income tax rate to 396 from 37 effective Jan.

Capital gains tax increase effective date Saturday June 18 2022 The proposal would increase the maximum stated capital gain rate from 20 to 25. It appears that the White House is planning to make the effective date for its proposed tax. The proposal would increase the maximum.

It is expected that the long-term capital gains tax rate change will be effective the day it is agreed to and announced with little to no advance warning The current estimate of. Includes short and long-term Federal and State Capital. Top earners may pay.

President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Legislative proposals cast a dark cloud this year.

The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987. The 1987 capital gains tax collections were slightly below 1985. Capital gains tax increase effective date Friday September 9 2022 Edit There have been two major increases in the tax rate.

Long Term capital gains from property is taxed at flat rate of 20 after taking indexation in account. There have been two major increases in the tax rate. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28.

Among other things the bill would increase the individual ordinary income tax rate from 37 to 396 increase the capital gains rate from 20 to 25 expand the application. Which leads to the oft-asked question of when. The effective date for this increase would be September 13 2021.

He also realized a loss of 30000. 1 2022 and the top long-term capital gains tax rate to 25 from 20generally effective for. An increase in the top capital.

That leaves just choosing the timing of recognizing capital gains for year-end planning. 2021 capital gains tax calculator. This proposal would be effective for.

In short we dont yet know the answer to this important. Taxpayers can consider triggering gain before the potential effective date of a capital gains change but should assess the outlook carefully and understand the risk. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

The proposal would increase the maximum stated capital gain rate from 20 to 25. 2022 capital gains tax rates.

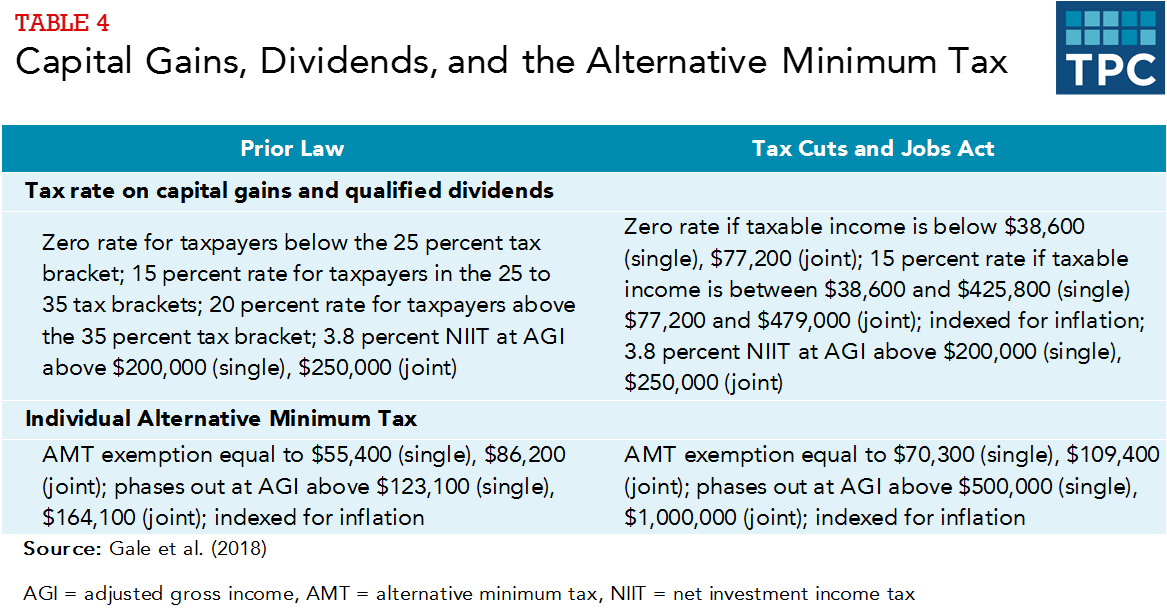

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

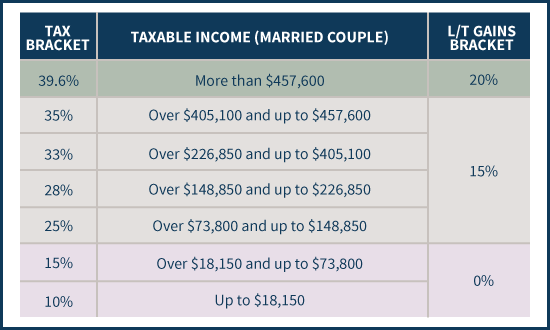

Mechanics Of The 0 Long Term Capital Gains Rate

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

43 4 Capital Gain Tax 10 Things To Know

When And How Much The Tax Rate On Capital Gains Will Rise Could Become Clear On May 27 When Biden Releases His Budget Financial Planning

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Advisers Blast Biden S Retroactive Capital Gains Proposal

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

An Overview Of Capital Gains Taxes Tax Foundation

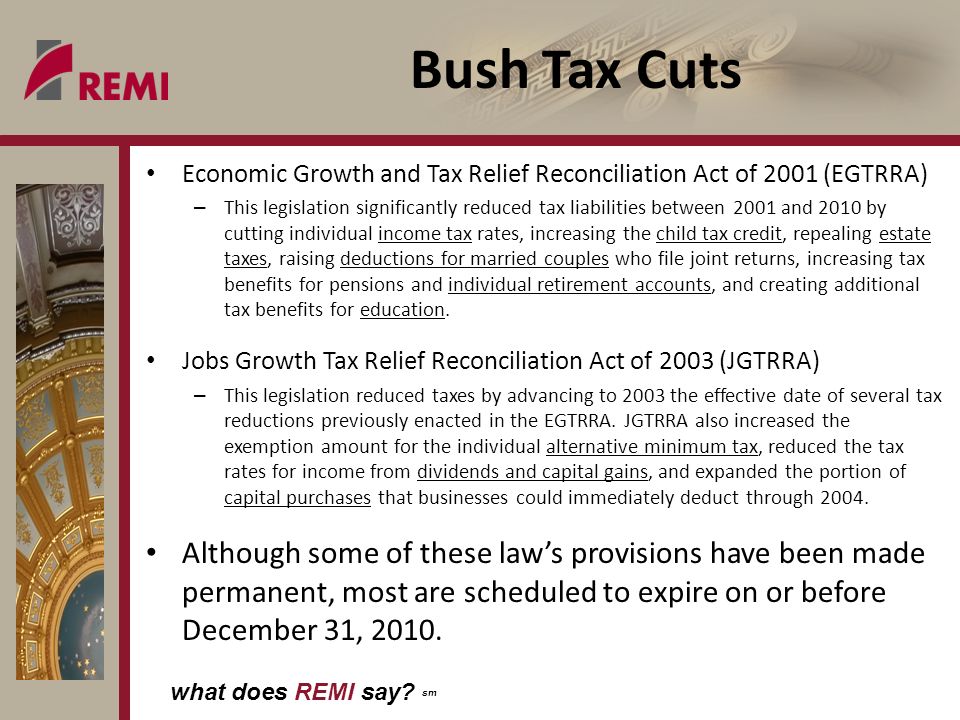

What Does Remi Say Sm Understanding The Effects Of The Bush Tax Cut Expiration Presented By Dr Frederick R Treyz Chief Executive Officer Fall Ppt Download

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

What You Need To Know About Capital Gains Tax

Summary Of Fy 2022 Tax Proposals By The Biden Administration

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Impact Of Green Book Capital Gains Proposals On Loss Harvesting Strategies Aperio