rank real estate asset classes by risk

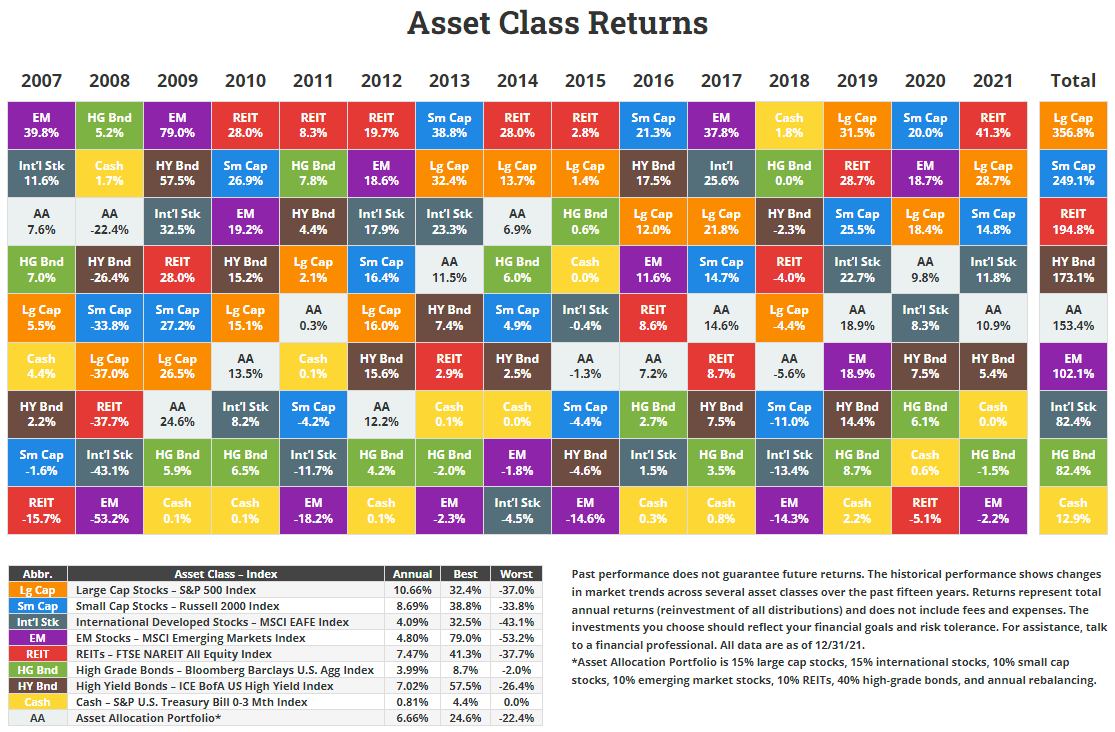

For investors to take on higher risks they would need to be adequately compensated for the additional risks that they bear. -Multifamily -Retail -Office -Student living -Light.

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

As for office it depends on market location and many other factors.

. No way does having longer larger leases make your cash flow more volatile. Ad Real estate investments brought to you by true real estate professionals. Each asset class is unique regarding the related risk taxation ownership exchangeability.

Find real estate and property information. The commercial real estate market is divided into six primary asset classes. Within private equity real estate assets are typically grouped into four primary strategy categories based on investment strategy and perceived risk.

ELIZABETH ASSETS GROUP LLC 69 ELMORA AVE ELIZABETH NJ 07202. The first asset class is real estate. Im mainly looking at.

The asset classes types include fixed income cash cash equivalents equity and real estate. In commercial real estate this gets defined as Class A. They are broad categories that include assets with similar characteristics and risk levels.

Thousands of investors have used CrowdStreet to invest more than 3 billion over 500 deals. A real estate investment trust is a company that owns operates or finances income-producing real estate. Over the last 6 years we have tracked 77 MLS listings by Daniel.

In commercial real estate this gets defined as Class A B C or D. What kind of building are you investing in. The Domestic Asset Protection Trust may hold investment assets and real estate including a personal residence.

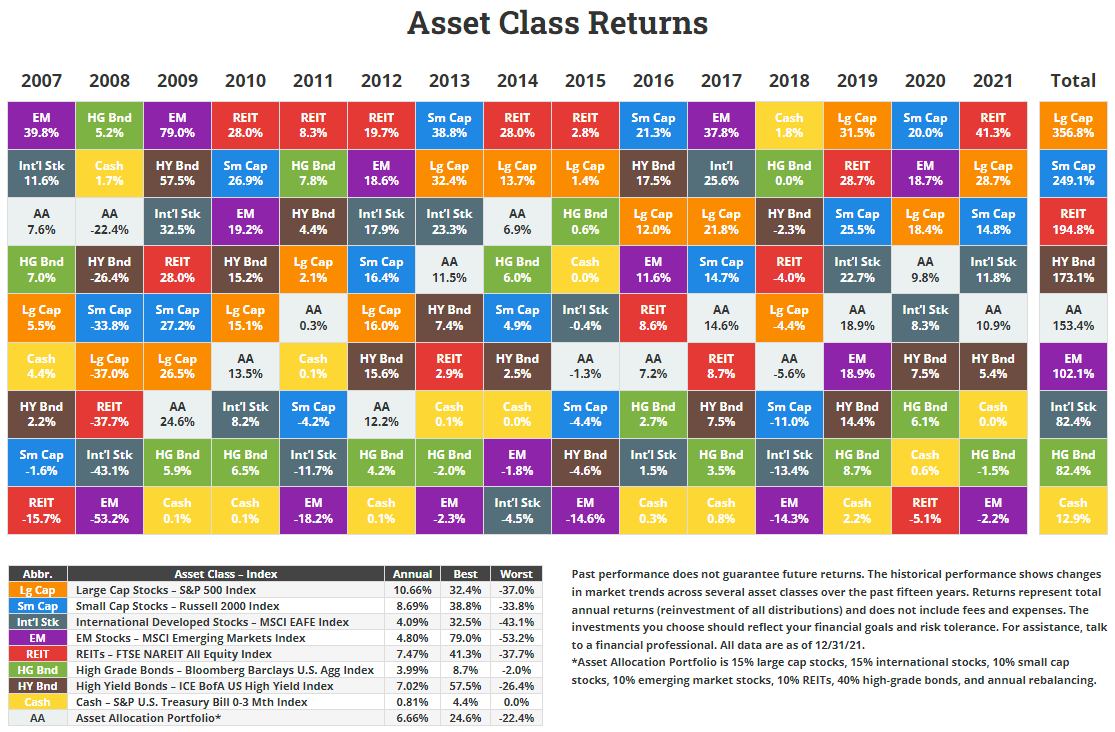

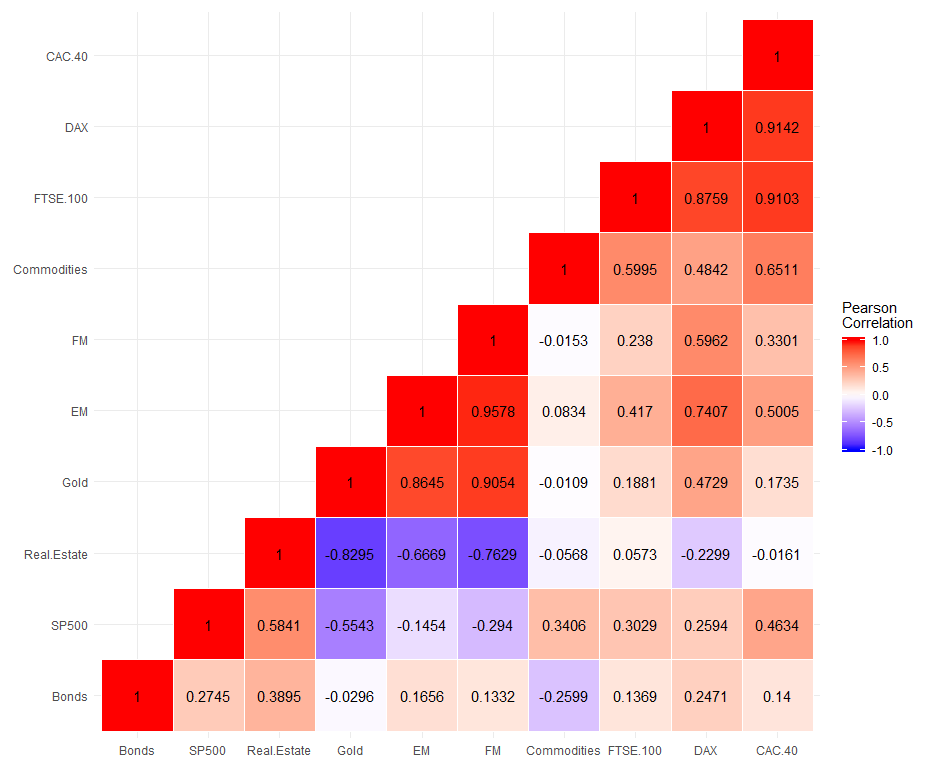

Most will rank them on a general scale from Class A to. Three traditional asset classes are equities or stocks cash equivalents or a Money Market and fixed income or bonds. In January of 2019 and 2020 I published year-in-review posts on the returns performance of various asset classes.

Weehawken real estate appreciated 9254 over the last ten years which is an average annual home appreciation rate of 677 putting Weehawken in the top 20 nationally for real estate. The top-performing asset class so far in 2020 is gold with a return more than four times that of second-place US. Within each asset class properties will be.

One example would be Real Estate. Learn why so many of our investors are repeat investors. Residential office industrial retail and hospitality.

The trust employs a trust company to serve as the fiduciary. Heres how total returns stack up by property sector sorted from. The Sharpe ratio is defined as average excess total returns over each period meaning simple average total returns minus the average return on a risk-free asset divided by.

For instance some office buildings in good locations like older Class B have numerous small tenants and dont have the same type of leasing risk as he described. Real estate has the highest risk and the highest potential return. Other Property by Owner.

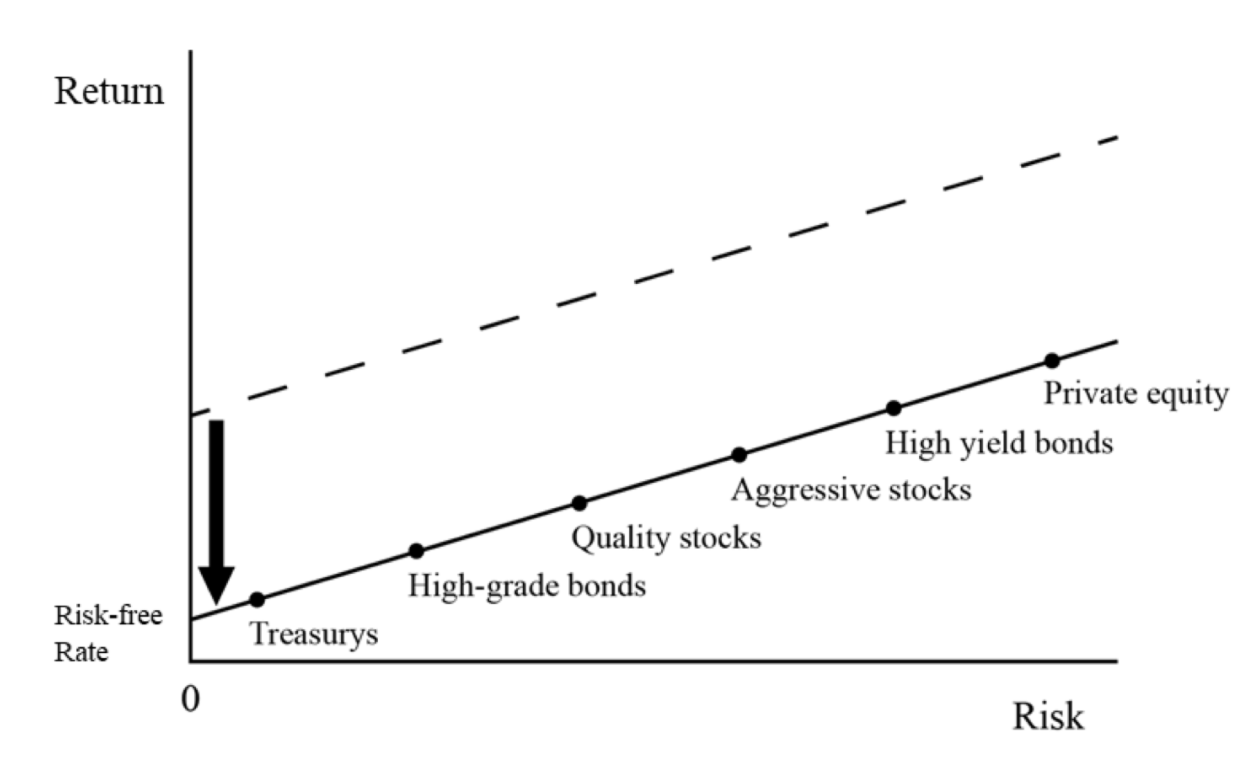

One way that real estate investors have tried to evaluate risk of 1 The Everything Everywhere Model is made commercially available through Northfield Information Services Inc. Additionally two common alternative asset. High risk with high return to low risk with low return.

Ranking The Historical Returns of Asset Classes. Our investors keep coming back. Real estate experts and investors share different perceptions when it comes to ranking property and area classes.

The most common asset classes are cash and cash equivalents equity fixed-income. On the other hand real estate investment trusts REITs. As an asset class real estate investments.

Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk. Ad Invest in diverse asset classes from multifamily industrial retail more on CrowdStreet. Daniel Heim is an active Real Estate Agent in Weehawken NJ with the brokerage Coldwell Banker Residential Brokerage.

Annual Asset Class Returns Novel Investor

How Housing Became The World S Biggest Asset Class The Economist

Top Etf Picks For Each Asset Class Etf Com

The Monolith And The Markets Short Message Service Johnson And Johnson World

Best Asset Allocation Based On Age Risk Tolerance Investing Personal Financial Planning Investment Portfolio

Commercial Real Estate Trends Toptal

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Know Your Real Estate Risk Reward Spectrum Before Investing

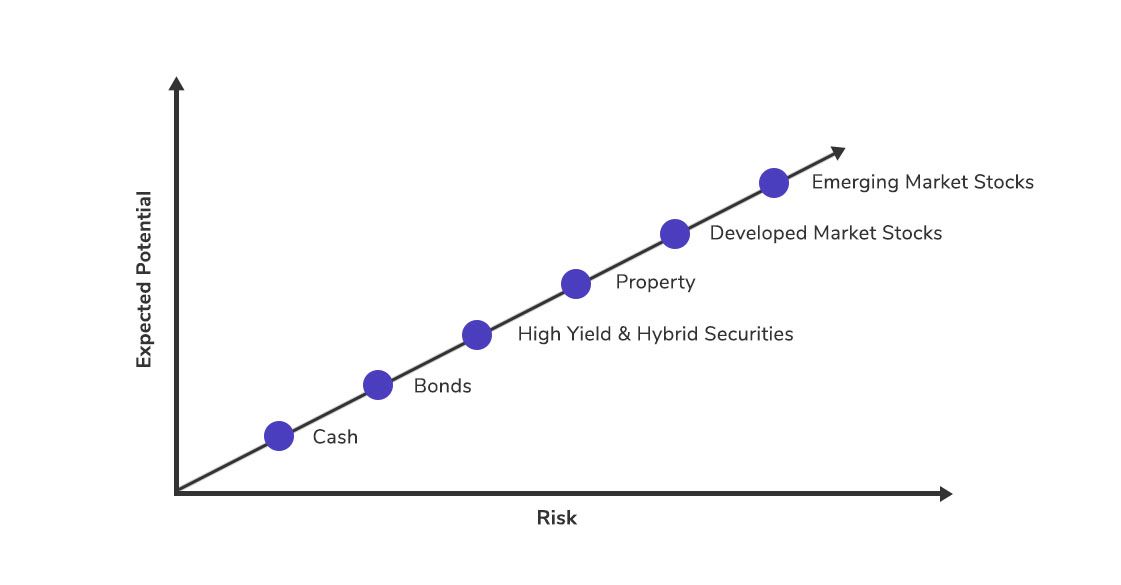

Asset Class Correlations In 2018 Seeking Alpha

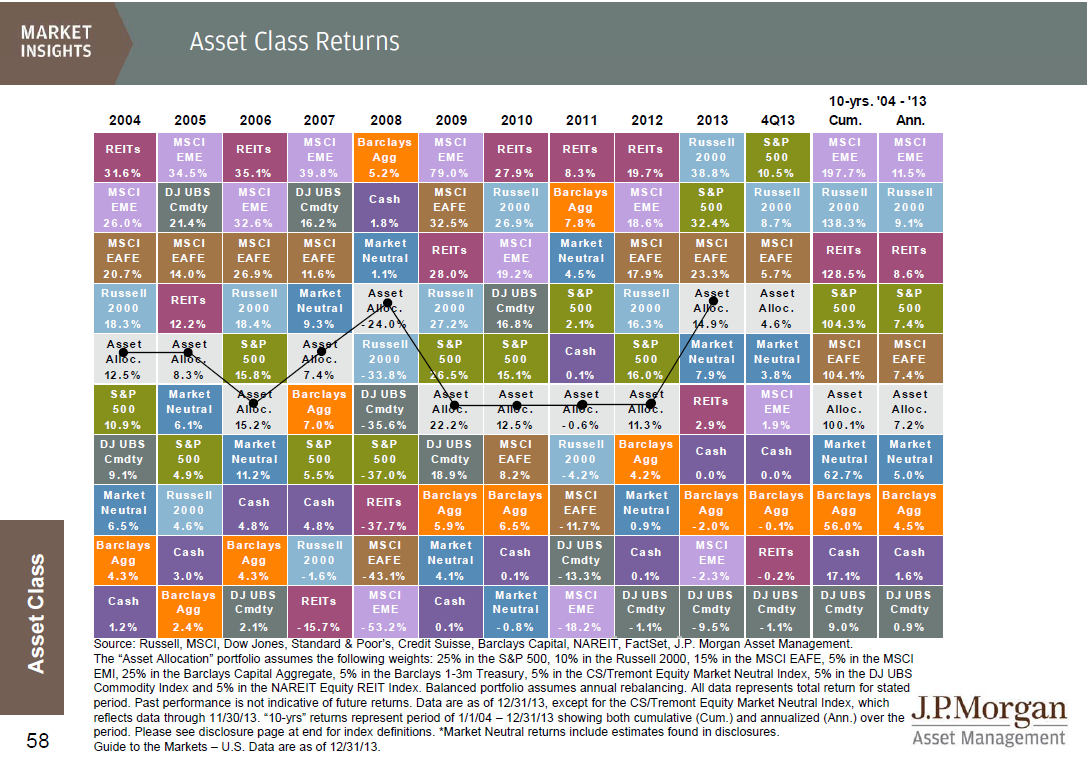

Asset Class Returns From 2004 To 2013 Seeking Alpha

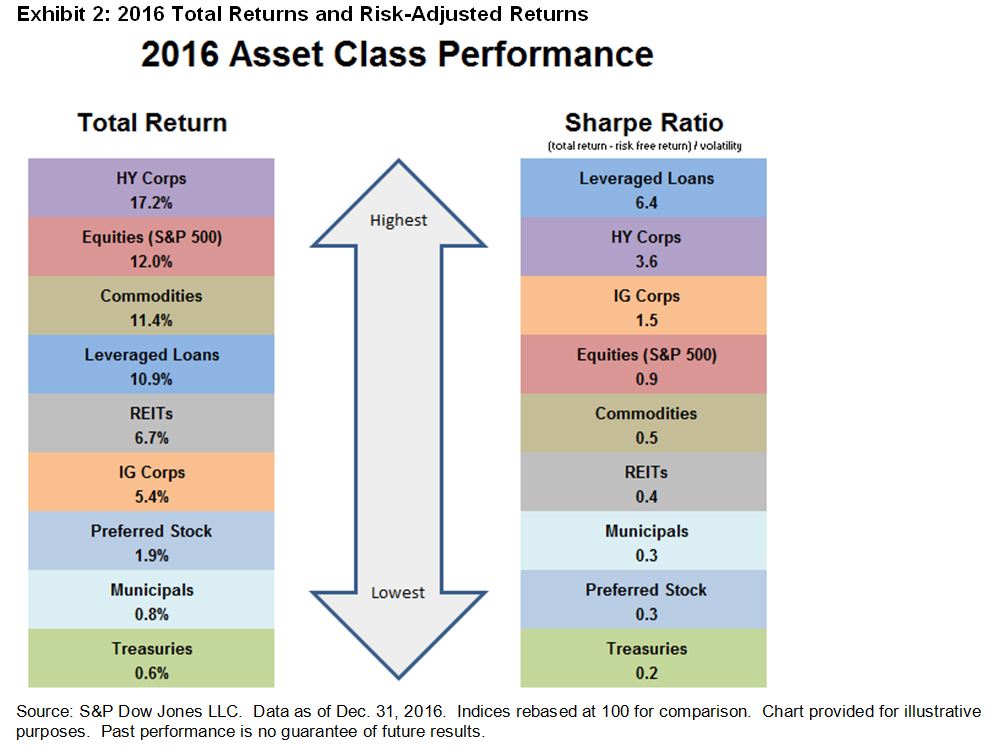

Year In Review 2016 Asset Class Performance Seeking Alpha

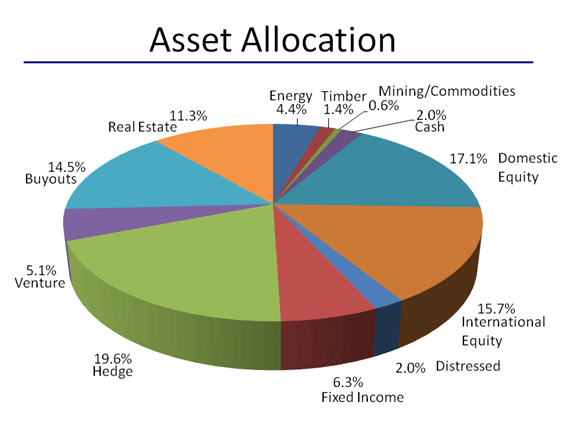

Lower Risk By Rethinking Asset Allocation Seeking Alpha

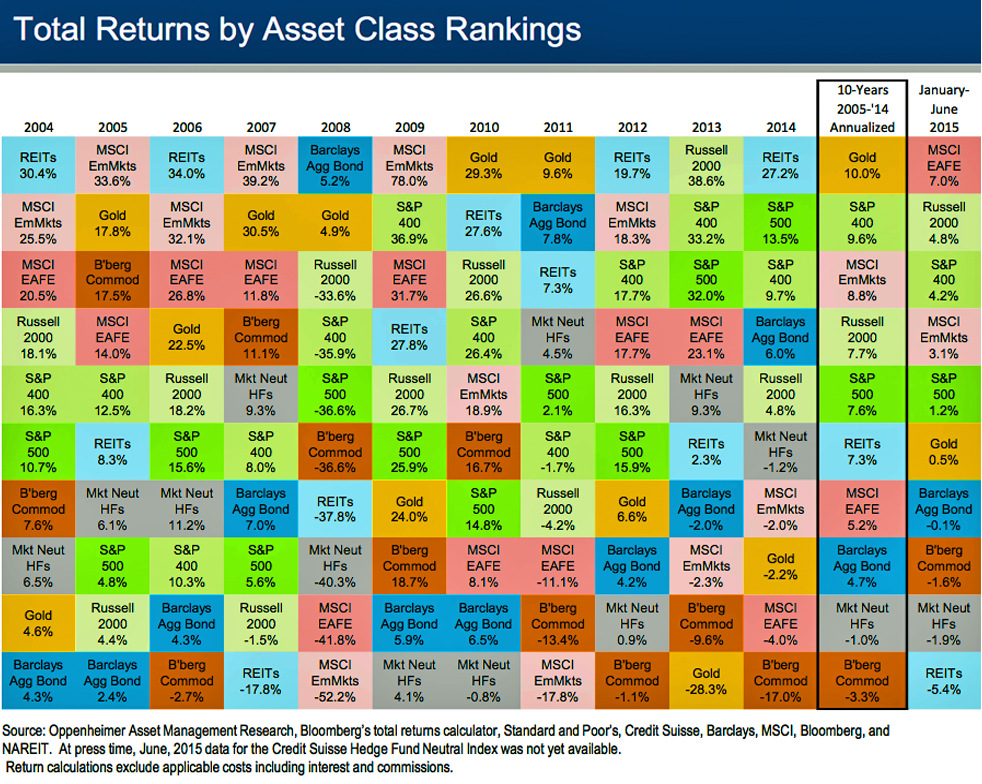

Chart The Historical Returns By Asset Class Over The Last Decade

Meyer Asset Management Ltd Tokyo Types Of Investment Funds Infographic Investing Finance Investing Mutual Funds Investing

All About Asset Classes And Investment Diversification The Motley Fool

Risk Versus Average Return Of Asset Classes Finance Perso

Expected Asset Class Returns Medium Term 5 10 Years Daytrading Com